Tier 4

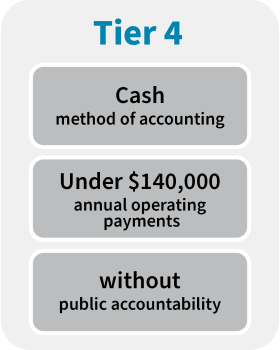

Charities with annual operating payments under $140,000 that do not have public accountability can choose to use the Tier 4 Standard. Refer to Which tier will I use? for more information about the tiers.

The updated accounting standards for Tier 4 charities introduced by the External Reporting Board (XRB) in 2023 now apply to most charities.

Please review the table below to understand which standard your charity is required to use for reporting to Charities Services. The Tier 4 (NFP) Standard can be used for any reporting periods that end after 15 June 2023 (i.e. for balance dates 30 June 2023 or after).

Last Day of Financial Year (Balance Date) | Annual Return Due Date | Applicable Accounting Standard | Optional Accounting Standard |

31 July 2024 | 31 January 2025 | Tier 4:Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) | |

31 August 2024 | 28 February 2025 | ||

30 September 2024 | 31 March 2025 | ||

31 October 2024 | 30 April 2025 | ||

30 November 2024 | 31 May 2025 | ||

31 December 2024 | 30 June 2025 | ||

31 January 2025 | 31 July 2025 | ||

28 February 2025 | 31 August 2025 | ||

31 March 2025 | 30 September 2025 | ||

30 April 2025 | 31 October 2025 | ||

31 May 2025 | 30 November 2025 | ||

30 June 2025 | 31 December 2025 |

New Tier 4 annual reporting guide and templates

A new Tier 4 annual reporting guide is available for charities. This guide explains the reporting process and provides step-by-step guidance for completing a Tier 4 performance report template.

You can download the guide and templates here:

Guide

Tier 4 Annual Reporting Guide

Templates

Simple Tier 4 (NFP) Template - excel [XLSX, 1.4 MB]

Simple Tier 4 (NFP) Template - PDF [PDF, 117 KB]

Full Tier 4 (NFP) Template - excel [XLSX, 82 KB]

Full Tier 4 (NFP) Template - PDF [PDF, 224 KB]

Note: the information below is currently being reviewed and updated to support charities using the Tier 4 (NFP) Standard.

How to complete your performance report and annual return

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Simple Tier 4 Reporting Template

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Tier 4 annual reporting resources and templates

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

How to use the Tier 4 Excel template

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Tier 4 example performance reports

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Tier 4 reporting webinars

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Tier 4 minimum categories

This relates to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard and the Tier 4 (NFP) Standard. Find out moreFind out more

Tier 4 member and non-member receipts

This relates only to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard.Find out more

Related party transactions for Tier 3 and Tier 4 charities

The Tier 3 and Tier 4 financial reporting standards require charities to report related party transactions. Related party transactions are recorded in the Notes section of the performance report.Find out more

Does your Tier 4 charity control another or other organisations?

This relates to the Tier 4 Public Benefit Entity Simple Format Reporting – Cash (Not-for-Profit) PBE SFR C (NFP) Standard and the Tier 4 (NFP) Standard.Find out more