Home » News & Events » Blog/Rangitaki »

The new Trusts Act – What does it mean for registered charities?

Charity registration applications are currently taking up to 20 weeks to process. We appreciate your patience.

Published 29 January 2021

[![]() 5 minutes to read]

5 minutes to read]

The Trusts Act 2019 is in effect from 30 January 2021 and if your charity is a trust then the Act applies to you.

If you are not sure whether you are a trust, search the Charities Register![]() and check your rules document. If it states you are a trust, then the Act applies. It is important trustees are aware of the Act and understand how it may impact on your activities and decisions. [1]

and check your rules document. If it states you are a trust, then the Act applies. It is important trustees are aware of the Act and understand how it may impact on your activities and decisions. [1]

The changes to the Act aim to make it easier to understand your duties as a trustee. In this blog we explain the changes that affect charitable trusts, including:

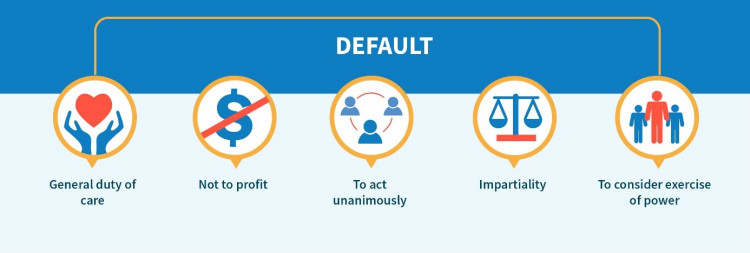

The Act sets out the duties of all trustees. These guide what is required of you as a trustee, particularly in making decisions. Duties already existed in the law defined in the courts, but are now included in the Act. The Act separates trustee duties into two types – either ‘mandatory’ or ‘default’.

Mandatory duties can’t be changed by the terms of the trust. The most important mandatory duty is to further your charitable purpose – everything you do as a trustee should be directed to achieve your charitable purpose.

Default duties include the ones above and must be performed by the trustee unless they are expressly changed by the words of your rules document. For a full list see the Ministry of Justice website![]() .

.

The Act also lays out other rules about how trusts must be managed. Similar to the mandatory and default duties, some can be modified by changing the trust rules and some cannot. See the key provisions below (this is not an exhaustive list):

| Rules that can't be changed | Rules that can be changed |

| All trustees must keep a copy of trust rules and amendments | General trustee powers, including power to invest |

| One trustee must also keep other key documents | A trustee’s power to appoint people to carry out the purposes of the trust – with certain limitations |

| Trust deeds can’t prevent a trustee being liable for any breach of trust arising from dishonesty, wilful misconduct or gross negligence | A trust’s powers to remove and appoint trustees, and what happens on a trustee’s death |

We recommend you review these duties and consider how they relate to you.

The duties show how important it is to read and know your trust’s rules, and the Act reflects this by requiring all trustees to hold a copy of the rules and any variations to them. There are other documents that trustees need to keep![]() (e.g. records of decisions, contracts, financial statements), but these can be held by one trustee on behalf of all trustees. It’s important all trustees have access to these records and we recommend they are kept electronically.

(e.g. records of decisions, contracts, financial statements), but these can be held by one trustee on behalf of all trustees. It’s important all trustees have access to these records and we recommend they are kept electronically.

The Act will potentially change how your trust works. You may want to change your rules to make it clear exactly what your duties now are. Focus on the following, as they are some of the key areas the Act addresses:

If your trust carries out business activities or manages complex activities and you have concerns about how the Act will impact on your operations, we strongly suggest you seek independent legal advice.

If you decide to update your rules because of the Act, you’ll need to check if your rules outline how they can be changed. Some older trusts can’t be changed so easily – if your rules don’t provide for how they can be changed, we recommend you seek legal advice. For most trusts, you can make a change with a "deed of variation" and changes can be processed very quickly.

This is a great opportunity to review your current rules, and make sure they are clear and comprehensive. If you are going to make changes, we recommend uploading a complete copy of the most current version of your rules rather than updating the Charities Register with many “variations”. For information on how to update your rules with Charities Services visit our webpage: Update charity details![]() .

.

You can find a simple template for a trust deed on the CommunityNet Aotearoa website![]() .

.

If you are registered under the Charitable Trusts Act 1957, the Companies Office has more information on making changes to a trust or a board's rules![]() .

.

The Ministry of Justice is responsible for the Trusts Act 2019, and you can find more information about Trust law reform![]() on their website.

on their website.

[1] You can read more about the different structures your charity can have in a previous blog: What to be or not to be - Incorporated Societies and Charitable Trusts![]() .

.

Thanks to Steven Moe of Parry Field Lawyers and Juliet Chevalier-Watts of the University of Waikato for their input into this blog.