Home » Reporting standards » Tier 3 »

How to record grant income in your accounts and in the Tier 3 Performance Report

This relates only to the Tier 3 Public Benefit Entity Simple Format Reporting – Accrual (Not-for-Profit) PBE SFR A (NFP) Standard and the Tier 3 (NFP) Standard.

Learn about grants and how to record them in your accounts and in the Tier 3 performance report.

A grant is money given to a charity by a grant funder for a specific purpose. Grant funders may be charitable trusts, foundations, philanthropic organisations, or central or local government departments.

Charities apply to grant funders for a grant. The grant funders then decide which charities or projects they want to fund and if successful, the charity receives grant money.

A grant can be received, for example, to help cover the day-to-day running costs of a charity, to purchase goods or equipment, or to help a charity carry out a specific project, activity or service.

It’s important for grant money to be recorded correctly in your charity’s financial accounts so that when you come to put your charity’s Performance Report together, you can easily record it in the correct format.

When your charity receives grant money, you will need to consider two things:

Are there any conditions attached to the grant, and

Under what revenue (income) category the grant money needs to be recorded.

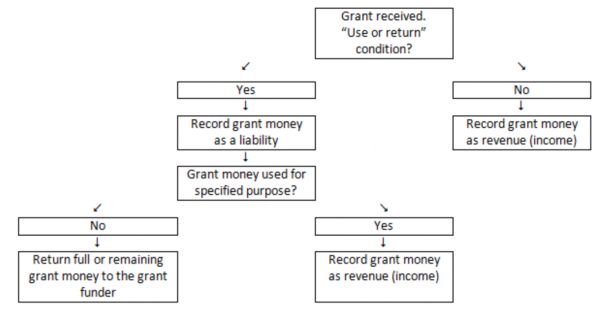

Most grants come with restrictions or conditions attached and this is often a “use or return” condition. What this means is that if a grant is given to your charity for a specific purpose, it must be used for that purpose and if not, the grant money needs to be returned to the funder. If there is any grant money left over after the money is used for the specified purpose, then any remaining amount must also be returned to the funder.

Most restrictions and conditions will not change how you record grants received in your financial accounts but “use or return” conditions are different as they do cause it to change.

Follow the flow chart below to find out where the grant money needs to be recorded.

It’s a good idea to keep track of the spending of grants throughout the year so that you know how much remains unspent at the end of the financial year.

If there is no “use or return” condition, then the grant money should be directly recorded as revenue (income) in your accounts.

ABC charity received a $5,000 grant with a “use or return” condition to purchase new office equipment: two laptops, two monitors and one printer. Because of the condition attached to the grant, ABC charity recorded the $5,000 as a liability when the money was received. They then purchased the equipment with the grant money, but only spent $4,500 of the $5,000 given to them. Their treasurer moved $4,500 from “liabilities” to “revenue”, and left the balance of $500 in “liabilities” until it was returned to the grant funder.

Where you record grant money in your performance report will depend on where your money is recorded in your accounts at the end of your charity’s financial year (balance date).

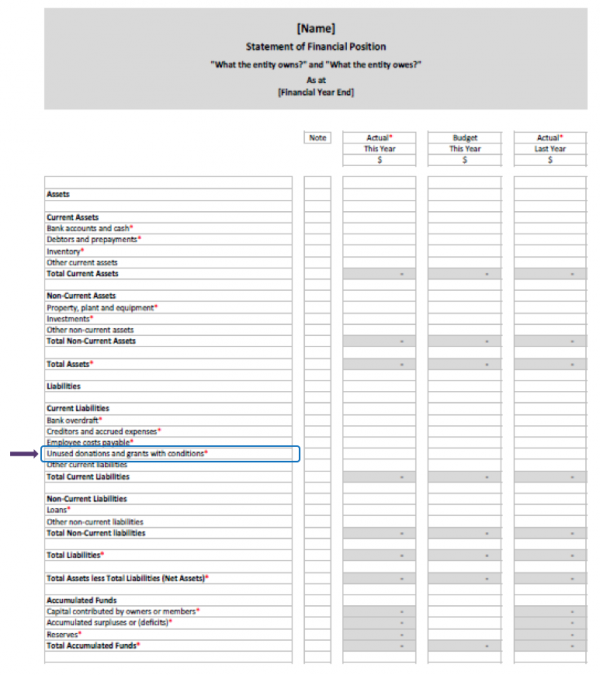

If the grant money is recorded as a liability on your balance date (as explained in the previous section), then that amount will need to be entered in “Unused donations and grants with conditions” under “Current Liabilities” in the Statement of Financial Position of the performance report.

If the grant has a restriction or condition which is not a “use or return” condition but has not been fulfilled at year end, you must disclose this. See page 14 of the template.

Imagine that the grant received by ABC as described above instead simply had a restriction stating that the grant was to be used for office equipment but had no requirement to return the money if unspent. In this case you would not recognise a liability for the unspent amount of $500. Rather, you would record in the notes to the performance report the details of the grant and the amount unspent. This is part of Note 7 in the template.

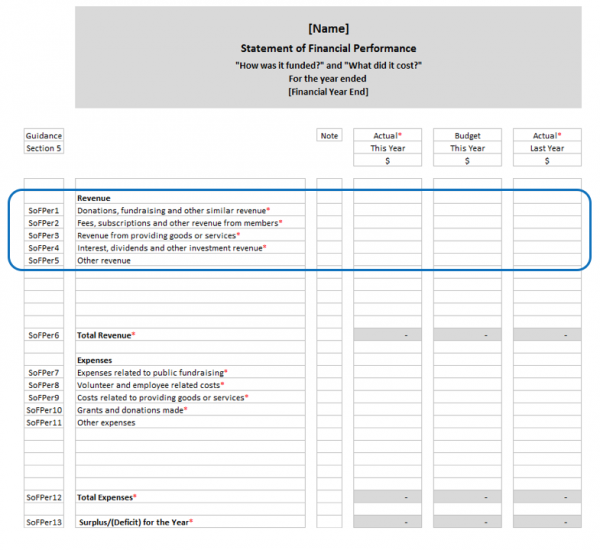

If the grant money was used and is recorded as revenue (income) in your accounts, you will need to know what the grant money was used for to determine where to record it in the Statement of Financial Performance of the Tier 3 performance report.

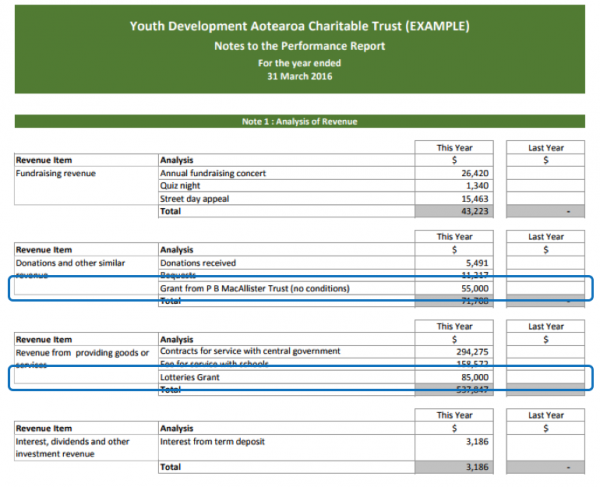

Your charity may have previously recorded grant revenue (income) as a standalone item in its financial records. However, in the Performance Report, grant income must now be allocated to one or more of the four minimum (compulsory) categories used to report all revenue. The category you choose will depend on what the grant money was used for, and will end up being grouped with other revenue (i.e. not just grant income) that falls into the same category.

The four compulsory revenue categories are as follows, and the two categories that grant income is most likely to fall under are shown in bold:

Donations, fundraising and other similar revenue

Fees, subscriptions and other revenue from members

Revenue from providing goods and services

Interest dividends and other investment revenue

These categories can be found under Revenue in the Statement of Financial Performance of the performance report

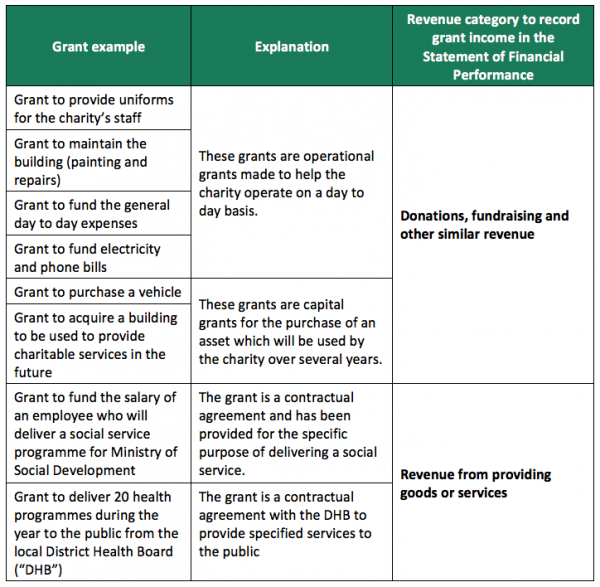

The revenue category/categories you choose to record your grant money under will depend on what the grant was given to your charity for.

Grants for the general day-to-day operation of the charity will be recorded under “Fundraising, donations and other similar revenue”.

Grants for capital assets, such as for purchase or improvement of IT equipment, facilities, vehicles or other equipment will be recorded under “Fundraising, donations and other similar revenue”.

Grants for delivering a specific service, project or programme will be recorded under “Revenue from providing goods or services”.

As explained above, grant income now needs to be grouped with other income into one or more of the four compulsory categories. This is to give your readers a clearer overview of what your income was used for by your charity. There are cases, however, where more information on the grant is required, for example a grant funder may want their name shown in the performance report. You can provide these details in the Notes section of the performance report. A charity may also wish to provide additional information to help readers understand the financial information. For example, where a grant has a restriction but not a “use or return condition” a charity may want to present a different version of the surplus to show that the grant was intended for use next year rather than in the current year.

Below is an example of how an example charity itemised its purchases with the grant money, and provided more explanation.

It’s important that you have a system in place to track details about any grants that your charity receives to make it easier to report correctly in your performance report.

Keep a grant-tracking system that notes:

The source of the grant

Allocate to the appropriate revenue category (in the performance report) according to the source

Any conditions attached to the grant

Note “use or return” conditions

How much of the grant is spent and how much remains

If you have to return a portion how much remains unspent