Which tier will I use? test

Updated 27 November 2024

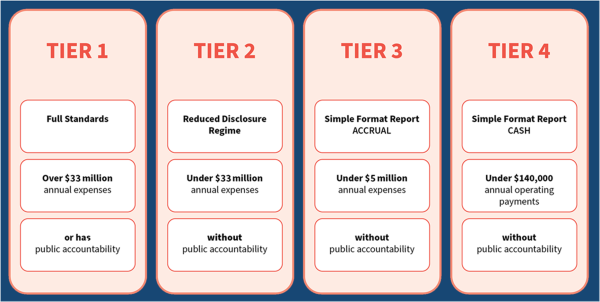

Registered charities must report to Charities Services using a tier system based on their annual expenses or operating payments from the past two years. The requirements for each tier is shown in the table below.

Determining your charity’s reporting tier

The accounting method you use (cash-based or accrual-based) depends on how complex your charity's transactions are and affects your reporting tier.

Cash-based Accounting (Tier 4)

In cash-based accounting, you only record transactions when you receive or spend money, not when you earn or owe it. This method is often used by charities with simple and small transactions. A cash book is often used to track these transactions.

Accrual-based Accounting (Tiers 1, 2, 3)

In accrual-based accounting, revenue and expenses are recorded when they are earned or incurred, even if the cash hasn’t been received or paid yet. This method is often used by charities with more transactions, and they may use accounting software or an accountant. Accrual accounting also includes things like depreciation and debts.

Does your charity have public accountability?

Most charities will not have public accountability as defined by the Accounting Standards(external link). Public accountability has a specific meaning for financial reporting purposes. An entity has public accountability if it:

- is listed on a public market (such as the New Zealand Stock Exchange)

- provides financial services to a wide group of people (this is common for banks, credit unions and insurance companies)

- is considered to have public accountability under the Financial Markets Conduct Act 2013.

If your charity has public accountability, it is required to report using the Tier 1 reporting standards(external link).

Moving to a higher tier

If your charity has become too large for your current tier (e.g. Tier 4 charity with total expenditure/operating payments over $140,000), you don’t have to change to the next tier immediately.

When you first exceed the size threshold, you are allowed two annual reporting periods before you are required to apply the next tier’s reporting standards. This means your charity is not required to change to the next tier until the third year when you exceed the size threshold.

Moving to a lower tier

If your charity qualifies to report under a lower tier, you can change to that tier in the first year if your operating payments are below the required amount. However, if you think your charity might exceed the threshold in the future, you can choose to keep reporting in the higher tier.

Examples of moving tiers

Example A

| Year Ending |

Total Operating Payments |

Guidance Note |

Tier Applied |

| 31 March 2018 | $160,000 | Charity no longer meets the Tier 4 criteria but may continue to use it | Tier 4 |

| 31 March 2019 | $145,000 | Charity no longer meets the Tier 4 criteria but may continue to use it | Tier 4 |

| 31 March 2020 | $110,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2021 | $135,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2022 | $145,000 | Charity no longer meets the Tier 4 criteria but may continue to use it | Tier 4 |

| 31 March 2023 | $120,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2024 | $130,000 | Charity meets the Tier 4 criteria | Tier 4 |

Example B

| Year Ending |

Total Operating Payments |

Guidance Note |

Tier Applied |

| 31 March 2018 | $100,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2019 | $125,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2020 | $135,000 | Charity meets the Tier 4 criteria | Tier 4 |

| 31 March 2021 | $145,000 | Charity no longer meets the Tier 4 criteria but may continue to use it | Tier 4 |

| 31 March 2022 | $150,000 | Charity no longer meets the Tier 4 criteria but may continue to use it | Tier 4 |

| 31 March 2023 | $165,000 | Required to move to Tier 3 this year | Tier 3 |

| 31 March 2024 | $180,000 | Charity continues to meet Tier 3 and continues to report in accordance with Tier 3 | Tier 3 |

Example C

| Year Ending |

Total Operating Payments |

Guidance Note |

Tier Applied |

| 30 June 2018 | $1,500,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2019 | $1,600,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2020 | $1,800,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2021 | $1,900,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2022 | $2,500,000 | Charity no longer meets the Tier 3 criteria but may continue to use it | Tier 3 |

| 30 June 2023 | $3,500,000 | Charity no longer meets the Tier 3 criteria but may continue to use it | Tier 3 |

| 30 June 2024 | $4,000,000 | Threshold changes to <$5 million and charity meets the Tier 3 criterai. | Tier 3 |

Example D

| Year Ending |

Total Operating Payments |

Guidance Note |

Tier Applied |

| 30 June 2018 | $1,500,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2019 | $1,600,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2020 | $1,800,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2021 | $1,900,000 | Charity meets the Tier 3 criteria | Tier 3 |

| 30 June 2022 | $2,500,000 | Charity no longer meets the Tier 3 criteria but may continue to use it | Tier 3 |

| 30 June 2023 | $3,500,000 | Charity no longer meets the Tier 3 criteria but may continue to use it | Tier 3 |

| 30 June 2024 | $5,500,000 | Required to move to Tier 2 this year | Tier 2 |

More information

For more details about the reporting tiers, visit the External Reporting Board’s website(external link).